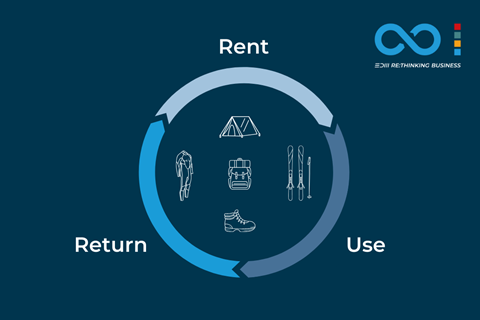

In a bid to reduce pressure on natural resources, the European Commission is in the process of transitioning industries to a circular economy through its new European Green Deal. At the same time, consumer spending patterns are changing, driven by growing environmental consciousness and increasing inflationary pressures. The result? We’re increasingly seeing companies moving away from traditional linear models of business and exploring different ways of operating. One such example is a switch to offering products as a service instead of as a one-off purchase – rental, in other words.

Rental is in fact predicted to be an economy that will be worth $700 billion by 2030, but while some huge players in the technical sporting goods and outdoor industries have already made a move into loaning out their products, why is it that others have been reluctant to take the leap? Will Renwick explains.

Recent schemes prove rental does not have to impact sales

Product rental schemes have been in existence within the world of technical sporting and outdoor goods for years, with the ski and snowboarding industry being a prime example. However, there is now greater diversity in the range of items available for rental. For instance, in April of this year, Kettler launched a home fitness equipment rental service. Around the same time, Decathlon introduced a rental program offering bikes, kayaks, tennis racquets, and camping equipment to its customers, resulting in a 2.4-fold increase in margins after just one rental season.

“We’re pleased with the uptake in Q1 and Q2 since the launch and have had some really positive feedback from customers and media about the service,” says a spokesperson at Decathlon, adding that they’re continue to have “ambitious targets” as they develop the business model.

British outdoor company Rab began renting out its tents, backpacks and mountaineering gear in March 2022 and, with plans to expand the service into Europe and North America, they are positive about how the scheme has progressed. “We have seen a lot of interest in the program by existing Rab customers,” explains Matt Clarke, Head of Customer Experience at the company, “but a lot of users have been new to the brand.”

Crucially, for those brands worrying that rental will take away from sales income, Clarke adds: “It certainly hasn’t impacted sales, it just opens up more options, offering something different to the consideration stage of the purchase experience.”

Clarke concludes that, for the sake of the environment, “the important thing is that rental is at least offered.” Indeed, increased rental can, when done right, mean that less production is needed in the long run and less raw materials are required.

Not a subscriber yet?

Dive deeper into the sporting goods industry with the latest insights and stories – straight to your inbox!

The Ellen MacArthur Foundation, a non-profit that promotes a circular economy, predicts that global Co2 emissions could be reduced by as much as 340 million tonnes by 2030 if rental, alongside resale and repair, continues to rise as forecasted. Singling out Decathlon, the Foundation reports that the French brand is achieving a 50 percent reduction in Co2 emissions and a 10 times reduction in use of water through each product that is rented.

Stigma and concerns of hygiene still present a challenge

While there are real business opportunities with rental, particularly when it comes to a brand lowering its carbon footprint, there are plenty of challenges.

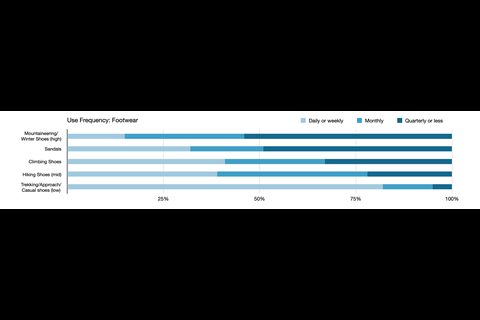

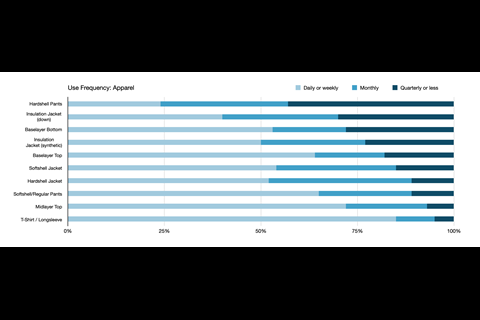

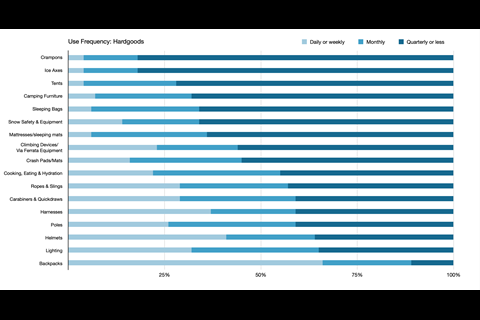

First of all, as highlighted in a 2020 report by the European Outdoor Group, not all products are suitable for hire. A survey carried out by the organization found that within the outdoor industry, Apparel had little room to increase the usage through rental programmes due to the frequency that owned products are worn. Products that are used infrequently, on the other hand, are better suited to rental with Hardgoods such as crampons, ice axes and tents offering the largest rental potential.

The use frequencies of outdoor products: Hardgoods, Apparel, and Footwear, with data from the European Outdoor Group’s, Citizen Survey, Lifetime of Outdoor Apparel, Footwear and Gear, 2020. For a comprehensive view, see our article from the EOG, Circular value chain? Don’t forget the consumer highlighting the challenges and possible solutions of circular businee models, including rental.

Clarke at Rab says that rental is still “not yet seen as ‘sexy’” and there is still work to do in the outdoor industry. “There have been massive gains in fashion rental over the past few years and expedition rental has been around for a long time,” explains Clarke, “but more general outdoor gear still suffers a little from the stigma of hand me downs and being outdated, well used and dirty.” This, however, is something that Clarke thinks can be addressed through Rab’s own service center, “ensuring that every piece of kit that goes out is in peak condition, offers protection and performance and is fit for purpose.”

There are also certain products that are too unappealing for many to consider wearing after someone else.

Anna Smoothy, Co-founder of Cirkel, a platform that specializes in the rental of ski clothing and equipment, says that while her company has had great success with ski pants and jackets, they have steered clear of merino base layers. “It’s largely because of the user’s concept of hygiene,” explains Smoothy. “Even though we’re capable of cleaning these items, it’s unpalatable for the user to think they’ve been worn next to the skin of another user, and sweated in.”

Recently UK surf and outdoor brand Finisterre announced that it will be moving into rental products for the first time, with customers now able to borrow sustainably made Yulex wetsuits on short term loans.

“Something like a wetsuit is a perfect product for rentals – for people just starting out who want to try it before they make that big investment,” said Richard Collier, CEO of Jack Wolfskin when we spoke to him for an exclusive interview. “We’re [Jack Wolfskin] certainly looking at tents as one thing that we think could be a strong rental business from our side – where we have some great products but not everyone wants to buy a tent for that weekend trip,” said Collier.

He’s not tempted to move Jack Wolfskin into rental just yet however. “I think in our case, rental is logistically a difficult thing to put together and we’ve recently had a lot of change in our business in terms of systems. We’ve made these massive complex changes that we’ve just not felt that we’re ready to handle a whole new business model right now.”

Therein lies one of the other obstacles brands are faced with when it comes to rental: It can often require specific software to manage the rentals, subscriptions and product tracking.

There is also the cleaning side of things with rental schemes adding additional costs associated with maintenance such as repair, washing, and reproofing.

The maintenance process Decathlon follows highlights the potential complexities here: “Factors such as safety, repair and refit processes along with efficiency and the space the rental service would take all had to be considered whilst we were setting up the service,” the company’s spokesperson explains. “All rental items go through an eco-friendly ozone laundry and sanitization process to powerfully eliminate odours, germs, bacteria and 99.8 percent of viruses. Following a cycle in the ozone chamber, the items are cleaner than shop bought articles and are sanitized to a medical grade standard.”

A third party approach to facilitate rental

What links companies such as Decathlon and Finisterre and also the likes of Vaude, The North Face and Adidas is that they use third party organizations to manage these systems and cleaning processes involved with rental operations.

Today, businesses such as Cirkel, Rentle, Lizee, and CaaStle offer SaaS (software as a service) solutions that are logistics ready. Lizee, for example, began working with Decathlon in 2021 to provide warehouse product management and cleaning and also product tracking, performance analysis, customer service and accounting integration. Its system is set up seamlessly with Decathlon so that customers can order any rentals directly through the Decathlon website.

“We thought about how to effectively share different things in the world, such as bikes,” says Tunomo Laine, CEO and co-founder of Rentle, a similar SaaS company to Lizee that serves Decathlon’s UK rental services. “We quickly realized that the lack of supply meant that the retail sector did not have the infrastructure to run a rental service. With Rentle, we wanted to make the circular economy easy for retailers and provide consumers with a quality user experience. We wanted rental to be as easy as buying a glass of milk from a kiosk.”

These types of third-party services are not in all cases a surefire way to rental success, however. Recently, an LA-based SaaS tent and outdoor gear rental platform called Arrive Outdoors – which Forbes had heralded as being a potential game-changer for the outdoor industry – had to completely cease its rental offering with the company now only dealing in product resales. So far, Arrive hasn’t commented on the motivation behind this decision.

Rental influencing design?

Regardless of these challenges, brands still need to take the right approach at all stages of the supply chain to ensure that this form of circularity can make a difference for our planet and to secure a future where rental is indeed commonplace.

In a report titled Rethinking Business Models For A Thriving Fashion Industry, the Ellen MacArthur Foundation highlights the “great potential of rental” but flags the risk of some companies and their approach, which does not achieve the environmental benefits of rental. For instance, companies still need to ensure that the back and forth of products and the way these goods are packaged each time they are rented doesn’t negate the carbon savings made by not creating brand new products.

The Ellen MacArthur Foundation also points out that for rental services to be sustainable, brands need to ensure that the regular use and wear and tear from the washing of products doesn’t inevitably end up with more items needing to be produced as replacements. This often starts with design.

But will the economics of rental naturally incentivize companies to focus on making products to last? After all, the longer a product lasts, the longer it can be rented out and the larger return for the company. Smoothy at Cirkel says she has already seen evidence of brands being influenced to adapt their products.

“We’re having these discussions [on durability] with some of our suppliers,” said Smoothy. “Houdini, as an example, has tasked us with feeding back data on which product components fail first (and when), and how their products can be designed for greater durability and repairability. We’re really excited to see how this will play out.”

Influencing greater durability and creating longer lasting products, reducing production and shifting both companies and consumers away from the fast fashion trend; there is ample evidence to suggest that rental services have the potential to bring significant benefits to our planet – and, as the likes of Decathlon, Rab and others are proving, there’s evidence that companies can benefit too.

-> Enjoyed this article? Find more of our circular economy content in our Re:Thinking Business special edition.